Got questions on where and how to use your prepaid card or whether you can use your prepaid card to make withdrawals. Find all the answers you are looking for with regards to using prepaid cards below.

Simply click on the arrow symbol or question to expand and see the answer

Are there spending limits on my prepaid card

The spending on your prepaid card on is limited to the value assigned by your prepaid card provider on maximum spend and/or withdrawal per day.

However, within that upper limit, how, where and when you spend your money using your prepaid card is totally up to you. Your spending power is limited only by how much money is loaded onto the card, up to the card issuer assigned value. When the money is gone, you just need to load more money to it. Remember to check the the terms and conditions for daily top up, spend and withdrawal limits and ensure that you are aware of any other usage restrictions on your card in the UK or abroad.

Can I spend more than the balance on my account

Well, you can certainly try but you will not succeed but in order to avoid embarrassing situations and potentially being stuck and unable to make a purchase, it is recommended that you ensure you have funds available on your card to cover your purchase and withdrawal needs.

At the end of the day, a prepaid card or a "prepaid credit card" as it is sometimes known as is not a credit card and you must never try to spend more than the balance on the card. Always make sure that there are sufficient funds in your account to meet any transaction. If not it will be declined. Not ideal when you are trying to flash some snazzy plastic on a first date!

Can I use my prepaid card for transferring money

Yes you can and this is possibly the most cost effective way of transferring money to your friends and family.

It is as simple as applying for an additional card on your account and then sending the card out to your family or friends. The primary cardholder can load funds in the UK and the secondary cardholder can access those funds using their card and also make withdrawals at ATM's in local currency.

The bottom line is that there is really no cheaper way to transfer and share money safely, securely and instantly.

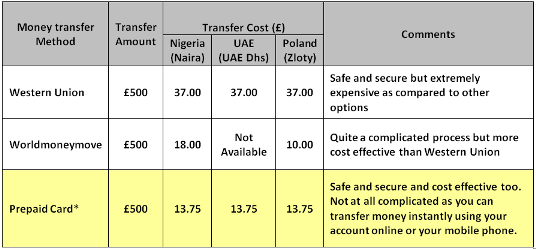

Comparison with Money Transfer Schemes

*2.5% Transfer Fee and + £1.25 International Withdrawal fee

Figures are meant as a guide only and are provided solely for information and interest purposes only, and not to either provide advice to, or to address the particular requirements of any individual.

Hence, it is quite noticeable that with a prepaid card, not only can you transfer and share your funds pronto (in an instant) but you could be save up to £23.25 as compared to some other providers to gain the same level of reliability and trust.

What about the Exchange Rate?

Using a Prepaid credit card will almost always save you even more money on international money transfer. Not only would you have benefitted from the actual transfer as shown above, but you are more likely to get a better exchange rate as compared to your traditional money transfer provider. If you regularly send money home and are looking to save money and time with a safe and secure money transfer solution, a prepaid card could be just the ticket for you!

Benefits of Prepaid Money Transfer Cards

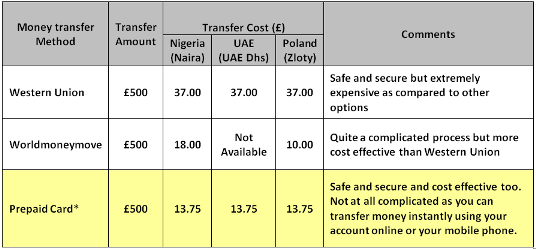

*2.5% Transfer Fee and + £1.25 International Withdrawal fee

Figures are meant as a guide only and are provided solely for information and interest purposes only, and not to either provide advice to, or to address the particular requirements of any individual.

Hence, it is quite noticeable that with a prepaid card, not only can you transfer and share your funds pronto (in an instant) but you could be save up to £23.25 as compared to some other providers to gain the same level of reliability and trust.

What about the Exchange Rate?

Using a Prepaid credit card will almost always save you even more money on international money transfer. Not only would you have benefitted from the actual transfer as shown above, but you are more likely to get a better exchange rate as compared to your traditional money transfer provider. If you regularly send money home and are looking to save money and time with a safe and secure money transfer solution, a prepaid card could be just the ticket for you!

Benefits of Prepaid Money Transfer Cards

*2.5% Transfer Fee and + £1.25 International Withdrawal fee

Figures are meant as a guide only and are provided solely for information and interest purposes only, and not to either provide advice to, or to address the particular requirements of any individual.

Hence, it is quite noticeable that with a prepaid card, not only can you transfer and share your funds pronto (in an instant) but you could be save up to £23.25 as compared to some other providers to gain the same level of reliability and trust.

What about the Exchange Rate?

Using a Prepaid credit card will almost always save you even more money on international money transfer. Not only would you have benefitted from the actual transfer as shown above, but you are more likely to get a better exchange rate as compared to your traditional money transfer provider. If you regularly send money home and are looking to save money and time with a safe and secure money transfer solution, a prepaid card could be just the ticket for you!

Benefits of Prepaid Money Transfer Cards

*2.5% Transfer Fee and + £1.25 International Withdrawal fee

Figures are meant as a guide only and are provided solely for information and interest purposes only, and not to either provide advice to, or to address the particular requirements of any individual.

Hence, it is quite noticeable that with a prepaid card, not only can you transfer and share your funds pronto (in an instant) but you could be save up to £23.25 as compared to some other providers to gain the same level of reliability and trust.

What about the Exchange Rate?

Using a Prepaid credit card will almost always save you even more money on international money transfer. Not only would you have benefitted from the actual transfer as shown above, but you are more likely to get a better exchange rate as compared to your traditional money transfer provider. If you regularly send money home and are looking to save money and time with a safe and secure money transfer solution, a prepaid card could be just the ticket for you!

Benefits of Prepaid Money Transfer Cards

- Instant money transfer

- One of the cheapest, if not the cheapest, ways to transfer money

- Safe and secure

- Can transfer funds between cards using SMS text

- Chip & PIN MasterCard® - can be used to shop online, in-store and over the phone at over 25 million merchants worldwide that accept MasterCard and over 9 million ATM’s to make withdrawals

Can I use my prepaid cards for shopping

Yes you can. You can use your prepaid card for shopping online, in-store or over the phone at millions of locations worldwide. The number of locations and worldwide acceptance depends on whether your card is Maestro, MasterCard or Visa branded.

There are big differences is card acceptance across the globe, so you need to take great care and ensure the card is right for your needs before making a final selection. If we look at some quick stats on worldwide acceptance, we see

- MasterCard - over 25 million worldwide acceptance locations

- Visa - over 12 million worldwide acceptance locations

- Maestro - over 7 million worldwide acceptance locations

Can I use my prepaid card on virtual world gaming sites

This question gets asked enough so it must be important and the answer is yes.

You can definitely use prepaid credit cards or prepaid debit cards are accepted on gaming websites such as Second Life, IMVU.com, RuneScape, Kaneva, There.com, Active Worlds, red light district and Entropia Universe amongst various others.

However, most of these sites will not accept Maestro prepaid cards, so it is better to use a MasterCard or Visa prepaid card. This, unfortunately, does restrict the number of prepaid card options available to the consumer, although with new MasterCard and Visa prepaid cards springing up every day, there is still an amazingly wide choice available.

You need to remember that to buy some virtual world money, you do need to dip into your real life funds.

So in summary, you can now take your real cash, load it onto a Prepaid MasterCard or Visa card and then buy virtual cash in your virtual world game. Alternatively, you could just try to get a job in the virtual world and spend a lifetime earning some money but we think the prepaid card is a faster, more convenient solution.

So find a prepaid card that suits your taste and purpose and start spreading the wealth in a virtual life today.

Some of the top virtual world sites of interest are as follows:

- www.clubpenguin.com

- www.habbo.com

- www.zetapets.com

- www.neopets.com

- www.marapets.com

- www.playdo.com

- www.fantage.com

- www.activeworlds.com

- www.cybertown.com

- www.doppelganger.com

- www.kaneva.com

- www.Nicktropolis.com

- www.secondlife.com

- www.stardoll.com/en/

- www.there.com

- www.grophland.com

- www.giropets.net

- www.imvu.com

- www.virtualfishtank.com

- www.roiworld.com

- www.thedollpalace.com

- www.millsberry.com

- www.whyville.com

- www.zwinky.com

- www.shiftreload.com

- www.doppelme.com

- www.adoptme.com

- www.dizzywood.com

- www.groovygirls.com

- www.trollz.com

- www.tibia.com

- www.poptropica.com

- www.maidmarian.com

- www.woogieworld.com

- www.pixelbee.com

- www.urbaniacs.com

- www.warbears.com

- www.awolnow.com

- www.runescape.com

- www.cyopets.com

Can I hire a car using my prepaid card

In most cases, the answer is that you must check with your prepaid card provider before you travel or decide to use your prepaid card for hiring a car.

Prepaid card issuers generally restrict this and do not allow a prepaid card to be used for car hire. The reason for this is quite simple although understandably, this can be a source of frustration for some consumers especially if they are travelling abroad.

Its actually down to the way car hire organisations operate. When you hire a car, your card is pre-authorised which means an initial authorisation is made on your card. This “holds” or reserves funds within your prepaid card account and makes those funds unavailable on your account from that point onwards.

Once you return the hire car, the car hire firm will charge you the agreed hire amount plus any additional fees that you may have incurred such as those for car damage, fuel shortcomings, extended usage, or a host of other charges as per the original agreement.

The car hire firm will now proceed to deduct this new amount from the prepaid card even if the funds are not available on the card and these might be in excess of the pre-authorised funds.

The bottom line here is that this can result in your prepaid card going overdrawn and the prepaid card issuer is not protected in this scenario, and is unable to chargeback the transaction to the hire company.

So the best advice would be to check with your prepaid card issuer in advance if they do in fact allow prepaid card hire and if not, find an alternative method of hiring a car to enjoy your trip and preventing undue stress or frustration afterwards. It's highly likely that Mrs Jones isn't going to be too pleased with Mr Jones who flew to Sydney as a first time home buyer to sign the loan papers on his brand new country home only to discover that his prepaid card issuer would not allow car hire; gave the term "going walkabout" a whole new meaning.

Can I use my prepaid card on adult sites

This question gets asked often enough so it must be important and clearly, for some people, prepaid cards provide a useful method of payment in these circumstances. The answer is YES.

The main reason for using a prepaid card on an adult site is the users desire to maintain their privacy. Prepaid cards ensure that there is a fair level of anonymity and users do not need to share their credit/debit card details online. It also means that unlike credit or debit cards, prepaid card issuers do not generate paper statements which are likely to end up on your doorstep through the postal services.

A prepaid card is not linked to your bank account which means that consumers feel more comfortable using it as opposed to a credit or debit card where large amounts of funds are potentially available. So a prepaid card is an altogether more safe and secure proposition.

It’s also unlikely that you will receive a call from the card issuers risk and security department, requesting that you confirm that the transaction is genuine.

However, not all prepaid cards are accepted on Adult sites. Major providers that process on behalf of Adult sites, such as CCBILL and IBILL etc, only accept fully branded MasterCard and Visa cards. So, prepaid cards with the Maestro brand mark are often not able to be used. Some prepaid cards, especially Maestro cards and those available to under 18's will also probably have restrictions on usage on website's with an adult theme.

Whilst the online dating game is tricky in itself, an explanation of that unusually creative merchant description on your paper statement can be trickier still.

So find a prepaid card that provides you with privacy and anonymity online and also helps you avoid having to use your credit/debit card details on such websites.

Can I use my prepaid card on eBay and PayPal

Yes! If you don’t have a debit or credit card, or are worried about using a card linked to your bank account or sharing your credit card details online, prepaid cards provide an excellent solution for making purchases on eBay and PayPal.

All you need to do is use your prepaid card to register on PayPal and start sending money or shopping on eBay immediately.However, if you are registering for a brand new PayPal account, your spending limit will be restricted to £1000. Once this threshold has been reached, you will be required to verify your PayPal account and register your bank account details, in order to lift this spending limitation.

In order for you to register your prepaid card, PayPal will check your address. So remember, the address that you provide when you set-up your prepaid account, must match the address details that you provide when registering for an account with PayPal. Failing to do so may cause you to experience some problems with the registration process.

You should also note that if you intend to set up an eBay sellers account, you will not be able to do so with your prepaid card as you would be required to provide your bank account details.

So essentially, you can use a prepaid card to on eBay and PayPal to buy goods but to set up a seller account, you need a bank account.

Can prepaid cards be used on gambling sites

Not all prepaid cards can be used on Gambling sites and not all gambling sites accept prepaid credit cards but there are exceptions to the rule.

Many of the prepaid credit cards available in the UK do have gambling or “Adult content” merchant restrictions. This is primarily as a number of the cards are available to persons under the age of 18.

However, some fully branded prepaid cards, do allow their products to be used, and they are accepted for online gambling.

Historically, if you didn't have a debit or credit card, you would have found it near impossible to register for an account with most of the UK’s top gambling sites.

However, this is no longer the case, and more and more consumers are using prepaid cards as a secure and safe way of instantly loading money into their gambling and online casino accounts.

- What do you need to do first? Apply for a prepaid card that does not restrict gambling and gaming transactions, as some prepaid cards available to those aged under 18 restrict some over 18 transactions.

- Registering an account with an online gambling company You can apply for an account now, and then register your prepaid card once received. Or alternatively, you can wait for your prepaid card to arrive, and then set-up an account.

- Neteller.com - Neteller represent an accepted payment mechanism on most gambling and gaming sites and offer their own prepaid card. Find out more about the Neteller Net+ Prepaid MasterCard

- Betfair.com

Can I download online music and video with my prepaid card

Isn't this what you are using already. Well, the answer is a resounding Yes.

In fact, gift cards which you buy from retail shops like HMV, Virgin, etc are prepaid cards which allow you to download digital music and video in HMV and Virgin Group stores only. When you buy a generic prepaid MasterCard or Visa card product, well you simply take away that restriction and can now use this anywhere that accepts MasterCard or Visa, respectively.

Can you open an iTunes account with a prepaid card?

Well, the answer is Yes again and and there are a few ways you can do it. You could walk down to your nearest apple store and purchase an iTunes gift voucher and open an iTunes account and start downloading straightaway. The only problem with doing this is that once the card is used, it’s finished and you cannot top it up or purchase any more songs or videos. Its a one time use card only and you can only use it to download iTunes.

The alternative is if a prepaid MasterCard or visa card. This is definitely a more popular option and represents the best way to get an iTunes account without having to use mum or dad's credit card. Parents are happy as they can set a reasonable limit to the content being downloaded and it is not their credit cards details being shared online and teens are happy as they know they have a limit but how they use it and where they download their digital music or video is their choice and they aren't just limited to an iTunes or Nokia store.

So what are you waiting for?

Will my card work in car park ticket machines

Well, it should but there have been instances reported where car park ticket machines have rejected payments from prepaid cards.

Some car park and other machines are unable to read certain types of card so your prepaid card may not work. It is best to have some alternate form of payment (clunky cash, if need be) to ensure that you are not stuck in the card park.

I see a transaction on my account that I did not make

If you see a transaction on your account that you did not make, you should call the customer services number provided by your prepaid card provider immediately with the date and place of the transaction together with your card details.

Most prepaid card providers will investigate your claim quickly and provide a resolution. However, most companies also reserve the right to investigate all requests before a refund is made, and there may be a charge involved. However, most prepaid card providers are quite understanding about this and the administration fee is only charged if the transaction investigated turns out to be a genuine transaction carried out by the cardholder and not a fraudulent one.

Check your prepaid card providers terms and conditions to see exactly what their stance and charges on investigations and refunds.

How are disputed transactions with retailers handled

A few prepaid card providers will investigate and help get you a refund but the stance of most prepaid card providers is that they are not responsible for the quality, safety, legality or any other aspect of any goods or services purchased with your prepaid Card

So essentially, if you have any disputes about purchases made using your prepaid Card, you should settle these with the person you bought the goods or services from and upon resolution, the retailer can out the funds back on to your card.

Not an ideal scenario but we expect consumer protection to improve and become standard as the market grows.

Can I use my prepaid card for ATM withdrawals

Reloadable prepaid credit cards allow you to make ATM Withdrawals.

There may be a charge for withdrawing money from an ATM (cash machine). A higher charge may apply when withdrawing money from ATM's abroad. You may also be able to use certain ATM's free of charge and/or make a limited number of free ATM withdrawals or deposits each month but it is best to check the terms and conditions of individual prepaid cards to find one that has FREE withdrawals or charges you the least.

Can I withdraw more than my balance from my Prepaid Card

A Prepaid Card is pay before card which means you need to put money on your card before you can actually spend using that card. This essentially means you can only spend up to the amount available on your card.

However, there are no credit or overdraft facilities available on prepaid cards which means that you can only spend or withdraw as much money as is available on your card minus any fees due for that transaction as well as any funds which have been blocked for any monthly fees, standing orders, etc.